I was intrigued by the headline of this Adweek piece a few weeks back, Lessons CPG Brands Can Learn From Startups. Before reading a word, I thought, “is it even possible?” There are lots of smart people at CPG companies but the organizations are hemmed in by the needs of myopic investors, beholden to retailers and culturally risk averse.

I was intrigued by the headline of this Adweek piece a few weeks back, Lessons CPG Brands Can Learn From Startups. Before reading a word, I thought, “is it even possible?” There are lots of smart people at CPG companies but the organizations are hemmed in by the needs of myopic investors, beholden to retailers and culturally risk averse.

Let’s start with the concluding paragraph of the piece:

“The future for CPG companies is bright. They have a huge advantage in their transition into the new age of shopping: They have brands with heritage and stories. Consumers love brands and they love stories. The more that CPG companies incorporate these entrepreneurial-minded strategies and tactics, the stronger their relationship with consumers will become.”

This is a fever dream, similar to believing that coal will fuel the future and that we are on the cusp of millions of $30/hour manufacturing jobs coming home to America. Perhaps we should print up some MPGGA merchandise (Make Packaged Goods Great Again, pronounced “Map-ga,”). Those red hats would look sharp sitting next to your desk calculator and fax machine.

The present and future for traditional CPG companies is anything but bright. The brands located in the “graveyard” section of supermarkets are in big trouble, stuck in the middle, literally and figuratively, being squeezed from both sides. Decades of relentless price promotion and line extending to point of no return have eroded brand equity, trained consumers to buy on price and loaded so many of the same features into multiple products in a given line that they’ve been all rendered meaningless. As I like to say, my favorite toothpaste is whatever is on sale at Costco.

And which brand has the better image? Trader Giotto’s Tomato Basil Marinara Sauce or Ragu? Isn’t the lower priced choice the more prestigious?

Which brings me to my second point about the relative strength of “heritage and stories” as “a huge advantage in their transition into the new age of shopping.” I would argue that despite all the noise we hear about storytelling, that package goods companies are still relentlessly focused on short-term gains and short-term tactics. Their shareholders don’t have the time or the patience to tell stories, or, as the author suggests, to emulate entrepreneurs by “(obsessing) over experience, not revenue…(focusing) on the consumer’s needs, not dollars per square foot.”

That’s never going to happen. They will relentlessly use short-term tactics to maximize short-term profits. It’s all about dollars per square foot and defending shelf space in Walmart. Stories that take time to read, absorb and take root, i.e., long-term, image building tactics, will lose out to rational features and claims every time.

Think about Gillette, still dominant, but on the decline.

As a Forbes article noted earlier this year, “P&G’s Gillette woes are… a reflection of the broader challenge facing traditional CPG giants. They are hurt by increased consumer preferences toward startup brands that have eaten into their share with an image that consumers often consider more authentic and fun.”

For Gillette, those competitive startups would be Dollar Shave Club and Harry’s. You could argue that by running an ad with a real-life blade maker, complete with a Boston accent, they are telling a story of sorts, one geared at humanizing the blade behemoth and communicating authenticity, all while projecting the confident authority of a brand leader.

I wonder if that message isn’t undermined by the underlying defensive posture of the ad. True, Gillette blades are still well made and lovingly crafted by real human beings with cute accents, but isn’t the big takeaway here that they’re less expensive than ever before?

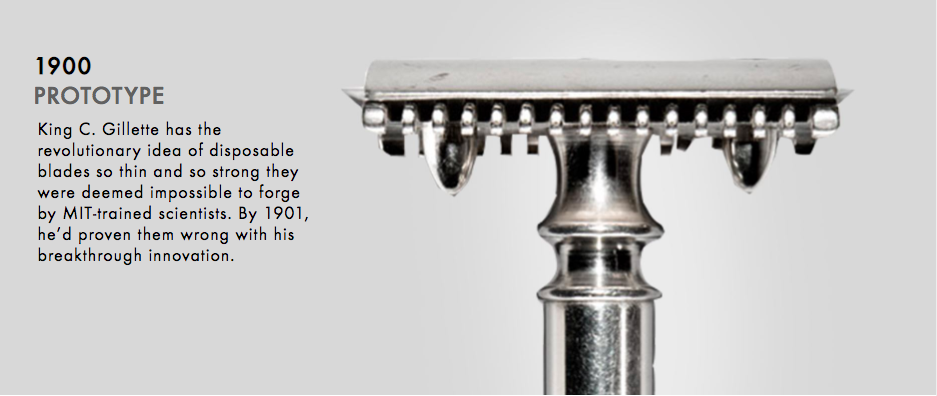

This is a shame, because Gillette has a rich history with a deep well of stories to draw on. Did you know there was a guy named King Gillette who invented to “safety razor” with the first truly disposable blade?

Did you know, as reported by a British website, “that during World War I, the U.S. Government issued Gillette safety razors to the entire armed forces. By the end of the war, some 3.5 million razors and 32 million blades were put into military hands, thereby converting an entire nation to the Gillette safety razor.”

Did you know, as reported by a British website, “that during World War I, the U.S. Government issued Gillette safety razors to the entire armed forces. By the end of the war, some 3.5 million razors and 32 million blades were put into military hands, thereby converting an entire nation to the Gillette safety razor.”

Those are some pretty powerful stories which to me, call for an attitude of, “Hey, we own this category. We invented it, defined it, and came up with virtually every shaving innovation over the past 100 years. You’re going to buy cheap blades on the web? Really?”

This is a good example of what’s wrong with our obsession with storytelling. It is true, as the Adweek author states, that “consumers love brands and they love stories.” Actually, I love love books and I love reading, but that does not mean that I’m going to love any random, trashy paperback snatched from the airport bookstore.

This is not a paint by numbers exercise. There are stories, and then there are stories. As has always been the case in marketing and advertising, anyone can blast out a message. The key is in telling thoughtfully crafted stories that are appropriate, motivating, and able stir up the precise emotions you’d like to associate with your brand.

Gillette certainly has to address the price gap. And along with that, they need to deal with the potential for consumers to interpret price cutting messages like the one in the current ad as, “We’ve been bilking you for years, but now that we have real competitors we can no longer overcharge.”

On a personal basis, that healthy, All-American capitalistic approach never really bothered me, not until the marketplace evolved with bold new options that were captivating both rationally and emotionally.

I used – and loved – Gillette products my entire life, and I paid whatever they wanted because I had strong emotional ties to the brands. I mean, do I look like the kind of guy that’s going to shave with Schick?

Starting to shave was a coming of age ritual in which Gillette played a special role. As I got older, I loved upgrading to the next great thing – two blades, three blades, five blades, along with the cool new handles you’d have to buy. I’d always have a bunch of the old blades left over, and despite the understanding that I’d paid good money for them and should use them up, I’d just toss them out. Why let money get in the way of shaving in the cool new way? Which, it should be added, was always tangibly better than what came before. The day I got married, I purposely made an early morning trip to a drug store to pick up the new, just introduced Gillette Sensor because I had to have the best-ever shave on my wedding day.

In addition to a compelling “Brand Myth” and what are likely dozens of fascinating heritage stories, there is no doubt that interviews with shavers of all ages would unearth all kinds of heartfelt, personal shaving stories like mine.

But Gillette isn’t telling them. Rather than focus on their consumers and their experiences – the kind of experiences the author of the Adweek piece feels that CPG brands should “obsess” about – they choose to focus on product features and price.

It was tough making the shift away from Gillette. Rationally, I accepted the trade-off that the shave might not be as good, though I felt it would likely be good enough. Similar to the Trader Joe’s cheap chic phenomenon, while the blades were half the price, the brand image of Dollar Shave held an important emotional appeal as well. The brand was younger, smarter and more modern.

But letting go was tough. There was that decades long, intimate, high-touch connection I had to Gillette. I resisted for a few years, but eventually made the move and never looked back. I have come to the conclusion that the shaves are not as good, but do I really want to traipse over to Costco (I’m not paying drugstore prices) for a brand that makes me feel old? I don’t think so. Gillette isn’t giving me a good enough reason, rational or emotional, to come back into the fold.

I wonder if the brand still would have grown stale for me had Gillette been telling me the right kinds of stories with resonant emotional messages. Regardless, the stories Gillette sends my way would be unlikely to connect with the young teenage/20-something customers they need to attract.

As compared to Gillette, Harry’s and Dollar Shave are able to tell newer, fresher, more relevant stories with far greater appeal for the young shaver. And some of us old shavers as well. I loved the original video for Dollar Shave that went viral. It was fresh, funny, and light-years away from Gillette in personality. Cleary, here was the next thing in shaving, razors, blades and related products delivered in a new way for a new generation. Harry’s “two guys who wanted to do it better” story isn’t all that unique, but it’s still a reflection of innovation and far more relevant to the zeitgeist than anything Gillette is doing.

I call brands like Gillette, Tide, IHOP, Cheerios and the like “Solid Citizen Brands.” These types of brands might be personified by Sean Connery. In 1965, when he played James Bond, he was the sexiest man alive. Now he’s a nice old man.

Old Spice, both a Solid Citizen and a P&G brand like Gillette, turned things around very nicely a few years ago, but they seem to be the outlier. In my future memoir, “Hey, I Thought of That!” where I list all the great innovative ideas I recommended to clients that never saw the light of day but were brought to life by other companies with great success years later, I’ll be sure to include this one.

About five years ago, I recommended to a client with a large presence in dental care a new solution to an age-old problem. While dentists recommend that we replace our toothbrushes ever three months, most people don’t get around to it for six months, a year, or even longer. It’s not so much the need to lay out a few bucks for the new toothbrush, it’s that people are just lazy or forgetful. So why not make it easy for them?

My recommendation was to build a web-based “Toothbrush Club.” Sign up, and for the price of three toothbrushes, get four, with one being automatically delivered to your home every three months along with a small sample tube of toothpaste (or other goodie). They’d have your credit card on file and your subscription would automatically renew

Dead on arrival. No one knew what to do with the idea at the time (“not my job”) and I was told that the retailers might get angry.

But kind of a good idea, don’t you think? Somebody did figure this out – that a subscription-based service would guarantee frequency of purchase for the company and enhance customer satisfaction as items that wear out and lose effectiveness would be replaced within a timeframe that provides peak performance at a fair price.

Not only is Dollar Shave selling lots of razor blades, they’re on to toothbrushes and personal care as well.

I wonder how long it will take for the big CPG companies to disappear from the S&P 500, and then from the face of the earth altogether. When the mighty P&G is under assault from activist investors due to shrinking market share amid increased competition from private label brands and upstart companies, it’s time to worry.

Is there nothing to be done? Well, I suppose there are lessons to be learned from start-ups…