CNN recently reported that “interest in Impossible Foods’ plant-based meat alternative is growing so much that the company is struggling to keep up.” You were out of luck if you tried to order an Impossible Whopper at many Burger King locations.

This was confirmed in a Wall Street Journal article that asked us to “pity the (traditional) veggie burger.” The piece went on to describe how some of the traditional brands were responding.

Kellogg Co.’s MorningStar Farms brand recently launched a “Meat Lovers” patty. Kraft Heinz Co. said it reformulated its Boca burger last year to improve taste and mouthfeel, including through more textured soy.

It is always far easier to follow than to innovate. Companies, sometimes without thinking, are quick to jump on the bandwagon when trends find traction and a category gets hot.

Food companies couldn’t make “low fat” versions of products fast enough in the 1990’s, including brands who had no business whatsoever playing in this arena. There were “Border Lights” from Taco Bell. Low-fat, lower-calorie versions of tacos and other menu items. The initiative failed quickly, demonstrating that just because something is “hot,” it doesn’t mean it’s right for your brand.

Several years ago I wrote about a Hot Pockets campaign aimed at “foodies.” Yes, the foodie thing was a trend, but not a fit for Hot Pockets. As with Taco Bell, fast, greasy, rich, filling foods like Hot Pockets have their place. “Good for you” or “the World of Foodies are not those places.

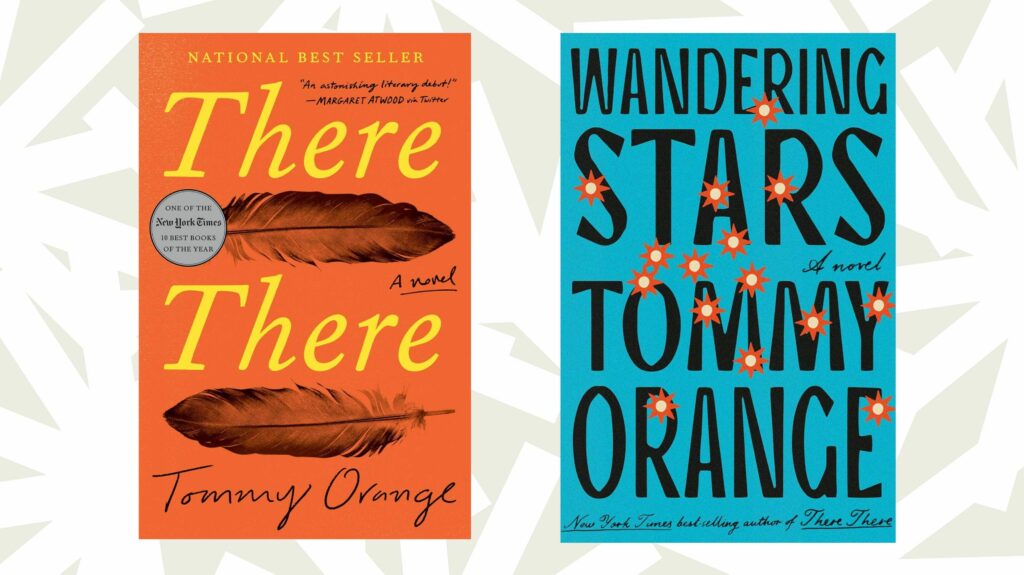

Now we have Beyond Meat and Impossible burgers, plant-based burgers that look and taste a lot more like real meat. It’s understandable that the traditional veggie burger brands want in. But should they?

It’s a question of the appropriate brand architecture, and I would argue that the MorningStar approach is dead wrong.

First, the original veggie burgers, products that don’t pretend to be meat, do not need our pity. There will always be a place them, even if that place is ultimately smaller than the faux-meat segment. Many vegans and vegetarians – now about 6% of the U.S. population – are likely to shy away from something that even reminds them of real meat. It may not be a look, taste or texture that is desirable to them. Moreover, omnivores looking for a change of pace might want alternatives that are not meat-like. This can and should be marketed as something positive.

More important is that the Morningstar, Garden Burger and Boca Burger brands are well-established and known for a certain kind of product. Will a “Meat Lovers” line extension really do the new product justice? Take a look at the MorningStar product line up in the photo below, taken from the brand website.

Is their Meat Lovers product, as presented here, something that can really compete with Impossible Burger? It’s lumped in with all the old MorningStar alternatives. Even if they nailed the product itself, producing something that looks and tastes as good as an Impossible Burger, this approach does not set up the proper expectations. Based on this look, do you think it will really taste like real meat, or more like the original MorningStar veggie burger?

This is not a time for mindless line-extension. The new meat-substitutes are a category of their own. Companies who want to compete will have to create entirely new brands both to be credible and to leverage the excitement of the new category.